When Do You Need a Will?

You may be wondering if it is time to draw up a will. Even if you don't have a large net worth, you may want your assets distributed according to your wishes if something should happen to you.

Markets ended November on a five-day winning streak

Markets ended November on a five-day winning streak, softening earlier losses driven by concerns over tech valuations, consumer sentiment, and rate uncertainty. While the Nasdaq slipped 1.51 percent, the S&P 500 held steady and the Dow inched up 0.32 percent. All eyes now turn to the Fed's final meeting of the year on December 9–10.

How Income Taxes Work

Taxpayers and businesses spend an estimated 7.9 billion hours a year complying with tax-filing requirements, which is worth $413 billion in economic value just to comply with tax regulations.

Intellectual Property Rocks in a New Digital Era

For artists and estate planners alike, it’s time to embrace the virtual, protect the intangible, and ensure that digital creations continue to deliver value—for now and for generations to come.

Global vs. International: What’s the Difference?

As of 2023, international stock markets accounted for approximately 40 percent of the world's capitalization, offering a broad range of investment opportunities outside the U.S. borders.

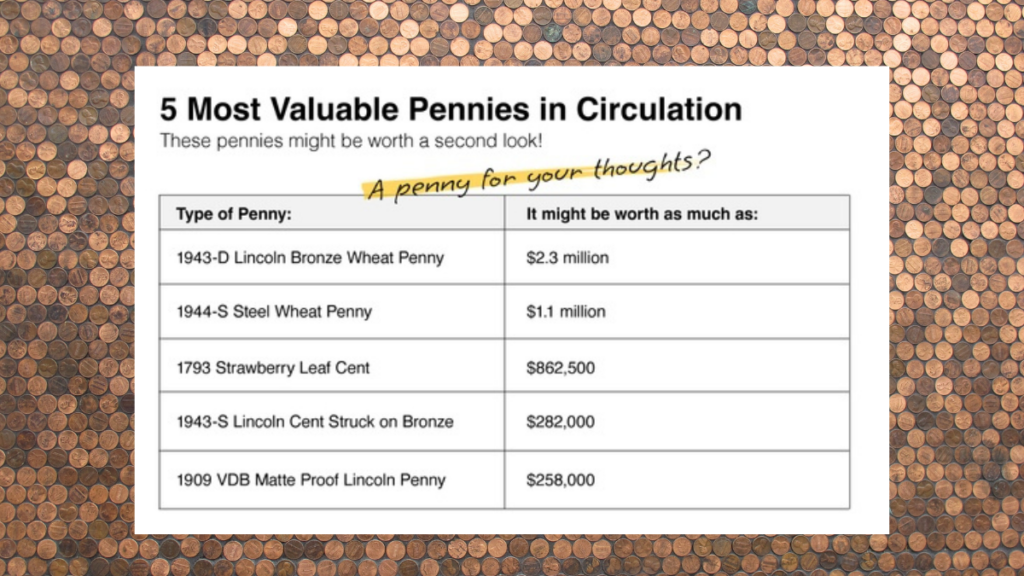

5 most valuable Pennies

Forget about wasting a couple by putting them in your loafers. And don’t even consider throwing them into a wishing well.

Don’t Fear Market Volatility: Lessons from Historical Corrections

Look at the headlines lately, and it becomes clear that markets may be in for a ride that's hard to predict— but we've seen this kind of turbulence before. When times feel uncertain, we know how crucial it is to maintain a broad and measured perspective....

Where should you invest?

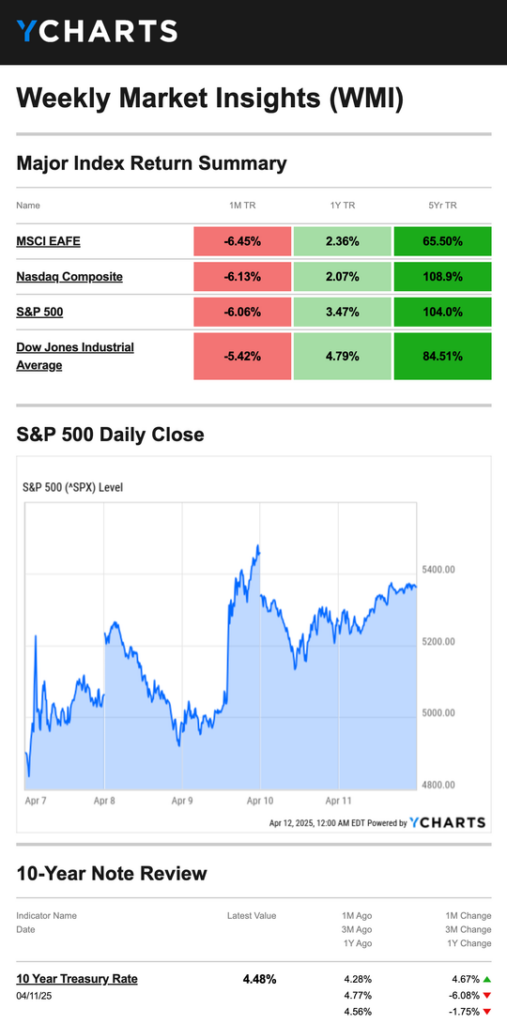

Stocks ended the week with a strong gain as traders continued to focus on tariff talks while appearing to overlook upbeat news on inflation.

Social Security Roadmap

Social Security is an important source of income for 91% of retirees, so deciding when to start benefits is critical. Here are a few quick questions to consider before drawing benefits.

The tariff-related questions that investors should be asking

“What should we do about tariffs?” It’s a question I’ve heard a lot lately, often with a note of fear in the voice of whoever is asking it. In this message, I want to answer that question. I also want to talk a little about fear, how we handle it…and how we can benefit from it.

Changing our Situation

There is so much to love about this story! One of the things I love most about it is that rather than giving up in a difficult situation, they set to work, gathered their network, and changed their situation.

Brief understanding of AI?

As you read financial headlines, or, if you’re really interested and read a lot of earnings reports, you will see the term AI used a lot. Why? And why is it such a game-changer?

Are Your Finances A Family Secret?

For a lot of us, many of our financial choices are based on the relationships we have with our families. I’m betting most of your finances are intertwined with your family.

Do you have any Financial Regrets?

As financial planning

is all about minimizing stress in your present and maximizing

confidence in your future, here are five common financial regrets to be aware of so you be sure to avoid them in the future. If you need help with any of these, remember that we are here!

The dust has settled, the votes have been counted

The dust has settled, the votes have been counted, and Donald Trump has once again been elected president of the United States. The dust has settled, the votes have been counted, and Donald Trump is once again president-elect of the United States. The...

Safeguarding Donations

Throughout the year, we all want to make a difference in the world. We are all looking for opportunities to donate to a great cause.

Black Tuesday – 95th Year Anniversary

You may not have realized it, but today marks 95 years since Black Tuesday—the day that sent the world into the economic turmoil of the Great Depression.

Retirement Activities – Something New?

I was speaking with a recently retired widow. She was telling me about her past week. While I wasn’t surprised by how busy she was. I was really surprised by how diverse her activities were.

2024 Q3 Market Recap

It’s always great to start with the words, “The markets finished the quarter at an all-time high.” Fortunately, that’s the case this time around. The S&P 500 rose 2% in September, and 5.5% for the entire quarter. The Dow, meanwhile, gained 8.2% in Q3. Both indices set new records along the way.

Trending Now 2024 a Long Expected Rate Cut

Over the last two years, the Fed has tried to do the seemingly impossible: Cool down consumer prices without starting a recession. To do that, the Fed turned to the only tool available: Interest rate hikes.

Cybersecurity Free Credit Freeze

Recently, a background check company called National Public Data confirmed they had experienced a data breach earlier in the year. As a result, the personal information of millions of Americans had been compromised – including, in some cases, Social Security numbers.

The Only Bad Question is the One Left Unasked: Breaking Down Financial Jargon

There’s no shame in being unsure, confused, or just curious. The same applies to financial matters, so I’ll tackle questions many people are too afraid to ask in this blog post.

Removing Trees & Financial Planning

It takes experience and knowledge to know where and how to cut to avoid damage, it takes experience to know where to look for roots before pulling a stump out. It takes a professional.

Family Conversations, Financial Decisions

For many of us, our financial choices are based on our relationships with our families. I’m betting that most of your finances are intertwined with your family.

Family Conversations – Passing on Details

Family conversations allow you to discuss your estate and legacy plans. While these conversations can feel awkward they are still important to have now.

What happens online when I die?

Our online presence has become an integral part of our lives in the digital age. From email archives to social media profiles and various online accounts, we leave behind a substantial digital footprint.

Understanding Inflation’s Impact on Retirement Savings and Strategies for Protection

Many look forward to retirement, envisioning a time of relaxation and enjoyment after years of hard work. However, achieving financial security in retirement requires careful planning, especially in the face of one significant challenge: inflation.

The Spotlight on Apple: What Investors May Be Talking About in June

As we move into June, the financial markets are abuzz with anticipation, and a significant portion of this attention is expected to shift toward Apple Inc.

Navigating the Implications of April’s Hotter-Than-Expected Inflation Report

In April, the release of inflation data sent shockwaves through the financial world as consumer prices surged higher than anticipated.

When your dog bites someone

When your dog bites someone, the liability may be covered by your homeowners policy, though there are exceptions.

Marginal tax bracket and holding period affect capital gains taxes

Understanding how marginal tax brackets and holding periods impact capital gains taxes is crucial for investors seeking to maximize their returns while minimizing tax liabilities.

What mortgage lenders consider when deciding whether you can afford a home

Mortgage lenders consider many personal factors when deciding whether you can afford a home.

Unveiling the Federal Reserve’s Influence on Your Portfolio: Decoding the Financial Markets

As investors, understanding the Federal Reserve's role and how its decisions may affect our portfolios is crucial.

Is there a role for both active and passive investments in your portfolio?

There’s often a spirited debate between proponents of active and passive strategies. Each camp champions its approach, extolling the virtues of its chosen method.

Earned Income and your 1040 Form

If you are simply reinvesting this income, you may want to consider moving the money to investments with the potential to grow tax-deferred.

Leveraging Programs: A Guide for U.S. Service Members

As service members dedicate themselves to protecting the nation, it's crucial they recognize the resources available to them beyond the battlefield.

Fire Retirement

The FIRE movement represents a paradigm shift in how people approach financial stability and retirement.

Can Group, Private Disability Policies Work Together?

Loss of income from disability has the potential to cause financial hardship. Disability insurance can help.

Keeping Summer Safe: Pool and Spa Safety Tips

Each year hundreds of children die or are injured in pool accidents. By taking seven steps, you can keep your pool safe.

When Heirs are Imperfect

The money problems or bad lifestyle habits of adult children could lead to the squandering of any inheritance they receive.

Critical Estate Documents

Sound estate management includes creating financial and healthcare documents. Here's an inside look.

Estate Management Checklist

A will enables you to specify who you want to inherit your property and other assets. A will also enable you to name a guardian for your minor children.

Insurance Needs Assessment: For Empty Nesters and Retirees

With the children now out of the house, financial priorities become more focused on preparing for retirement

Preparing for Longevity

The financial aspect of longevity requires careful consideration; those nearing retirement age and those just starting work may have misconceptions about aging, not realizing that they may live much longer than their forebears.

Filing Final Tax Returns for the Deceased

The federal government requires deceased individuals to file a final income tax return.

Traditional vs. Roth IRA

One or the other? Perhaps both traditional and Roth IRAs can play a part in your retirement plans.

Investing with Your Heart

Some individuals believe that return on investment shouldn't be the only criterion for how they invest their money.

Tax Deductions You Won’t Believe

While Americans are entitled to take every legitimate deduction to manage their taxes, the Internal Revenue Service (IRS) places limits on your creativity.

The Long Run Women and Retirement

For women, the retirement strategy is a long race. It’s helpful to know the route.